Welcome,

Elon Musk

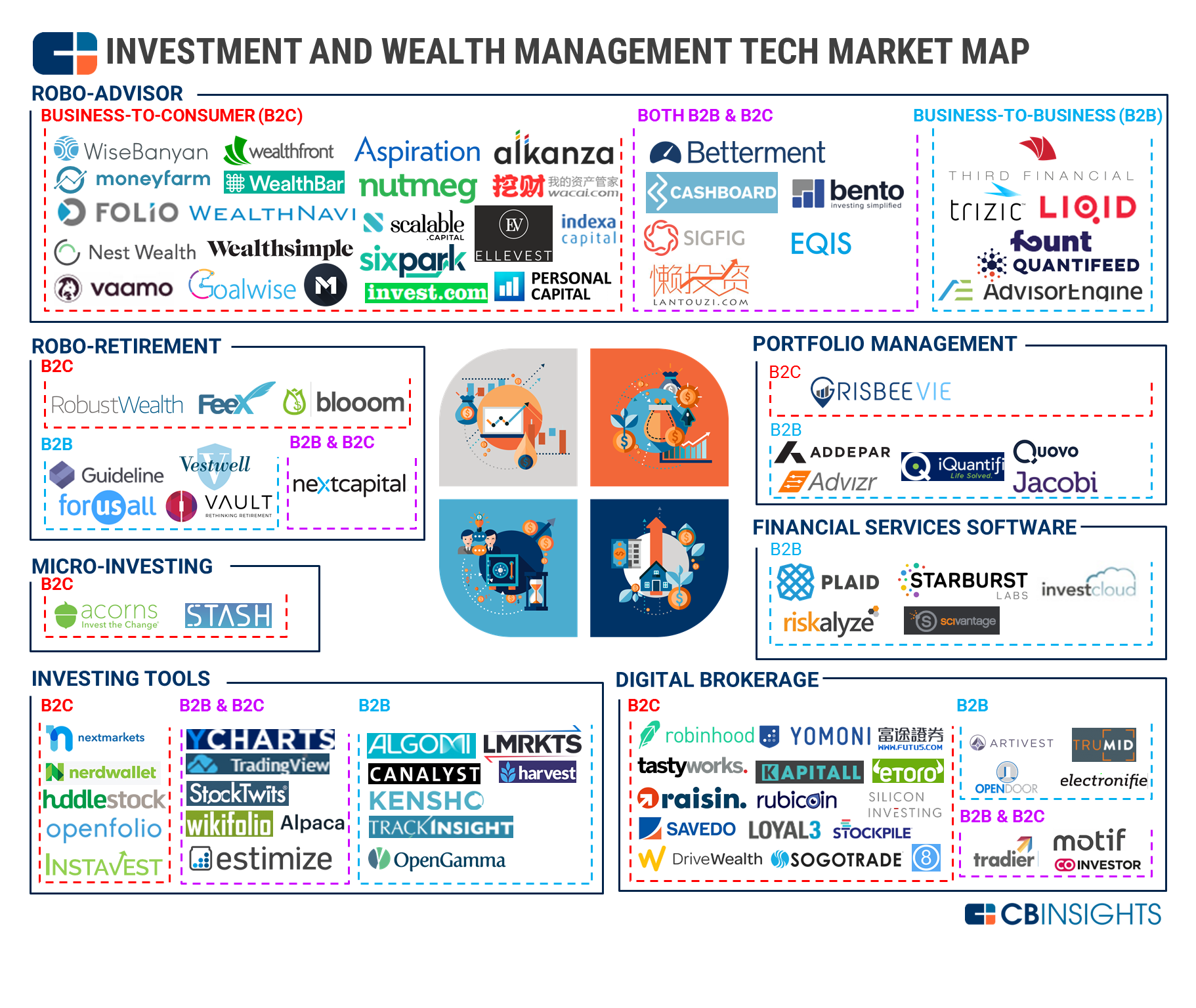

Wealth Tech Market Map: 90+ Companies - from CBInsights

Wealth Tech Market Map: 90+ Companies - from CBInsights

Transforming Investment And Wealth Management. From robo-advisors to mobile investing, fintech startups continue to create technology aimed at retail investors and advisors.

We define investment & wealth management tech to include fintech companies that offer an alternative to traditional wealth management firms and technology-enabled tools that are advancing the investment and wealth management profession. This includes full-service brokerage alternatives, automated and semi-automated robo-advisors, self-service investment platforms, asset class specific marketplaces, and tools for both individual investors and advisors to keep up with the changing dynamics in wealth management.

This category excludes both personal and corporate expense management and monitoring tools, tools specific to investment banks, and high-frequency trading platforms.

The category breakdown is as follows

- Robo-advisor: This category includes automated investment platforms that leverage technology to lower account minimums and reduce annual advisory fees. The investments offered are tailored to the client’s risk profile typically based on a questionnaire. Robo-advisors differentiate themselves through a range of added services that can include a 24-hour automated support desk, access to a human advisor, tax optimization, and portfolio re-balancing.

- B2C: B2C robo-advisors target individual investors. One of the most well-funded robo-advisors is Wealthfront. Wealthfront has raised approximately $129.5M from investors, including Social Capital, Spark Capital, Greylock Partners, and Index Ventures.

- B2B: These companies offer white-label software for advisors and financial services firms to offer an automated investment strategy to their customers. This includes AdvisorEngine which raised a $20M Series A investment from WisdomTree Investments.

WEALTH TECH MARKET MAP

| Logo | Company | Description | Category |

|---|---|---|---|

| Alkanza | A global B2B SaaS platform with AI & Machine Learning at its core, providing leading financial institutions with a suite of automated advisory products to better serve their customers. | Robo-Advisor - B2C | |

| Aspiration | Get cash back on every dollar you spend - and extra rewards for shopping at businesses with a conscience. Plus, track the impact of your spending on People and the Planet. | Robo-Advisor - B2C | |

| Ellevest | Get started investing in minutes with a company designed by women, for women. | Robo-Advisor - B2C | |

| Folio | FOLIO is applying technology to the field of asset management. The company not only offers an algorithm-based service, which acts as an automated money manager for lower fees and less initial capital than traditional services, but also provides an easy-to use thematic investing platform where users can select investment opportunities from a variety of trends and technologies. | Robo-Advisor - B2C | |

| Goalwise | Goalwise provides a goal-based investing platform for retail investors. Users just need to tell Goalwise their goals (vacation, children's education, retirement) and the company's algorithms create an optimum investment plan to achieve the goal according to unique risk profile. The investment plan consists of the asset allocation over time (glide path), the best Mutual Funds for the user, and how much to invest in every month to achieve the goal in the desired time frame. | Robo-Advisor - B2C | |

| IndexaCapital | Indexa Capital offers an online platform that gives users the ability to invest their money the right way. | Robo-Advisor - B2C | |

| invest.com | INVEST.COM and BITTREX Launching New Digital Trading Platform | Robo-Advisor - B2C | |

| M1Finance | The 1 finance account that does it all | Robo-Advisor - B2C | |

| MoneyFarm | Moneyfarm looks after your tomorrow, so you can invest time in today. From Pensions to ISAs, we offer cost-efficient investment advice on your portfolio and manage it all on your behalf. | Robo-Advisor - B2C | |

| NestWealthAssetManagement | Save More of Your Money. With our low-capped management fees, you’ll only ever pay between $20 to $80 per month—no matter how big your account grows. | Robo-Advisor - B2C | |

| Nutmeg | We’re on a mission to democratise wealth management. Our experts build and manage sophisticated global investment portfolios designed to help grow your wealth and reach your goals. | Robo-Advisor - B2C | |

| PersonalCapital | Link all your accounts for free to see a clear real-time view of your entire financial life. | Robo-Advisor - B2C | |

| ScalableCapital | Get a personalised, globally diversified and fully managed portfolio. We optimise your portfolio and monitor risk based on the latest quantitative research. Not just cheaper, but better. | Robo-Advisor - B2C | |

| SixPark | Simply smarter investing. Expert financial advice online. | Robo-Advisor - B2C | |

| Vaamo | Vaamo is a Frankurt based FinTech startup that helps with setting up and managing investments. | Robo-Advisor - B2C | |

| Wacai | Wacai is a Chinese FinTech company that has developed an all-in-one online personal financial management platform that provides users with wealth management services and credit solutions through an extensive portfolio of mobile apps to meet their evolving lifelong personal financial service needs. | Robo-Advisor - B2C | |

| WealthBar | WealthBar is an online investment service that matches clients with a dedicated online advisor to coach them through a comprehensive financial plan tailored to their lives, while providing them with a professionally managed ETF portfolio. | Robo-Advisor - B2C | |

| Wealthfront | Wealthfront is a robo-advisor offering the combination of financial planning, investment management and banking-related services exclusively through software. Anyone with $500 can open a Wealthfront investment account which offers access to the company's unique PassivePlus investment strategy and comprehensive automated financial planning service. | Robo-Advisor - B2C | |

| WealthNavi | WealthNavi offers a cloud-based asset management and robo-advisory service that helps middle-income people better locate diversified investments internationally. | Robo-Advisor - B2C | |

| Wealthsimple | Wealthsimple is a technology-driven investment manager that combines a robo-advisor platform with access to live advisors. | Robo-Advisor - B2C | |

| WiseBanyan | WiseBanyan is an online platform that creates and manages a fully-diversified portfolio of stocks and bonds. | Robo-Advisor - B2C | |

| AdvisorEngine | Advisor Engine, formerly known as Vanare, is a next-generation wealth management platform for investment advisors to help grow their business. As a technology platform that fully integrates Online Wealth Management, CRM and Portfolio Management in a seamless solution, AdvisorEngine offers RIAs a comprehensive, integrated experience with flexibility across workflows, data and usability, empowering advisors to aggregate assets. | Robo-Advisor - B2B | |

| Fount | Fount is a robo-advisor company that offers customized financial portfolios – tailored to each customer via machine learning technology and asset allocation algorithms. Its robo-advisor engine named Bluewhale, calculates the optimum combination of assets by combining financial engineering technology with asset allocation theories. Bluewhale then monitors the financial markets around the globe, allocating assets based on market changes through 'dynamic rebalancing'. | Robo-Advisor - B2B | |

| LiqidInvestments | Liqid Investments, aka Liqid Asset Management, provides private investors (entrepreneurs, professionals and other affluent individuals) with access to investment strategies, asset classes and conditions previously reserved for high net worth investors. The strategies available on the company's digital platform have been developed in collaboration with HQ Trust. | Robo-Advisor - B2B | |

| Quantifeed | Quantifeed's automated investment platform allows banks, brokers and wealth planners to offer their customers a digital investing experience under their own brand. Quantifeed's software and financial models provide institutions with a configurable solution to suit their wealth management objectives. This allows firms to reach hundreds of thousands of consumers quickly and economically. | Robo-Advisor - B2B | |

| ThirdFinancialSoftware | Third Financial is a provider of Investment Management Software and FCA Regulated Platform Services to the financial services industry. | Robo-Advisor - B2B | |

| Trizic | Trizic is a provider of enterprise-class digital advice technology that is developing easy-to-use software solutions that connect clients, wealth management firms, and the middle office to elevate client satisfaction, efficiency, and profitability. Trizic accelerates wealth management firms' success through deep collaboration, maximum flexibility, and customizable technology platforms built for financial professionals' and clients' real-world investment needs. | Robo-Advisor - B2B | |

| SigFig | SigFig, provided by Nvest and SigFig Wealth Mangement, is an online service that makes it easy for users to manage and improve investments. The platform offers actionable advice, insightful charts and graphs, real-time portfolio tracking, an overview dashboard, and smartphone apps. | Robo-Advisor - Both B2C & B2B | |

| Betterment | Betterment is a goal-based online investment company that delivers personalized financial advice paired with low fees and customer experience. Through its platform, Betterment's seeks to eliminate the typical complexities and time commitment of the traditional investment account. Behavioral guardrails built into the account help users make savvy, rational decisions with their finances. | Robo-Advisor - Both B2C & B2B | |

| CashBoard | CashBoard acts as a digital investment intermediary enabling private as well as institutional investors to deposit sums starting at €100 in a diversified way. CASHBOARD users benefit from fully automated algorithms for portfolio management, risk mitigation and tax optimization. Investors are able to deposit their money in traditional as well as innovative assets like funds, shares, real estate and overnight deposit accounts as well as P2P lending, crowdfunding and social trading. | Robo-Advisor - Both B2C & B2B | |

| EqisHoldings | Eqis provides a cloud based platform designed to maximize flexibility, choice and value to financial advisors and their clients. | Robo-Advisor - Both B2C & B2B | |

| Lantouzi | Lantouzi offers financing services to small and medium business, as well as wealth management products for individual investors. | Robo-Advisor - Both B2C & B2B | |

| Bento | Bento by Mesitis is a Bionic Robo Advisor targeting Banks, Wealth Managers, HNWI & Institutional clients. Its proprietary algorithm aids unconflicted, cost effective and customizable portfolio construction based on Markowitz Portfolio Theory and Charles D. Ellis low cost index investing. Bento is a forward-looking fundamentally led asset allocation model with Strategic and Tactical asset allocation. | Robo-Advisor - Both B2C & B2B | |

| FeeX | FeeX is a service that finds and helps reduce fees within investment and retirement accounts like IRA, brokerage accounts and more. Simply link investment accounts and FeeX's sophisticated algorithm uncovers advisory, investment and expense ratio fees and suggests alternative ways to save and reduce the cost of retirement. | Robo-Retirement - B2C | |

| Robustwealth | RobustWealth is a digital wealth management platform built by and for investment advisors, and engineered to satisfy their unique needs. It integrates previously modular features into one seamless suite that advisors can leverage to optimize their practice on their clients' behalf. The easy-to-use technology is delivered in a completely private-labeled environment. | Robo-Retirement - B2C | |

| Blooom | Blooom develops an online tool that assesses a consumer's 401(k) and provides ongoing professional management. The company is a Registered Investment Advisory firm. | Robo-Retirement - B2C | |

| ForUsAll | ForUsAll is an independent 401(k) advisor specializing in low cost 401(k) plans for small and mid-sized businesses. The company seeks to craft a low-cost retirement plan by finding clients the right fund lineup and recordkeeper. | Robo-Retirement - B2B | |

| Guideline | Guideline aims to make it easier for small and medium-sized businesses to offer 401(k) retirement accounts with a SaaS-based offering that includes a small fee for setup and charges monthly based on the number of employees that participate. | Robo-Retirement - B2B | |

| Vault | Vault is a modern investment platform providing 401(k), IRA, and retirement plans for small business. Vault partners with banks as a direct distribution channel to business clients who need their service. | Robo-Retirement - B2B | |

| Vestwell | Vestwell is a platform that helps investment advisors evolve their business to suit the changing landscape of retirement investing. Vestwell provides Registered Investment Advisors with a white-labeled platform to align with the latest rules and regulations and scale their business to provide 401(k) planning to companies and their employees. | Robo-Retirement - B2B | |

| NextCapitalGroup | NextCapital is a provider of enterprise digital advice. NextCapital partners with world class institutions to deliver personalized planning and managed accounts to individual investors across multiple channels including 401(k), IRA, and taxable brokerage accounts. The company's open-architecture digital advice solution provides integrated account aggregation, analytics, planning and portfolio management, and allows partners to customize advice methodology and fiduciary roles. | Robo-Retirement - Both B2B & B2C | |

| Acorns | Acorns is a financial services company focused on facilitating micro investing by enabling the investment of aggregated sub-dollar amounts in fractional shares with high frequency and allowing people to save and invest their money. The Acorns app, which leverages a proprietary brokerage and advisory engine, rounds-up credit and debit card purchases to the nearest dollar, then automatically collects and invests that spare change into a portfolio of index funds offered by money managers Blackrock. | Micro-Investing - B2C | |

| Stash | Stash is a mobile app offering users a way to invest based on goals, interests and beliefs. Stash helps people start investing with small sums, gain investing confidence gradually, and build smart financial habits for the long-term. | Micro-Investing - B2C | |

| 8Securities | 8 Securities provides online security brokerage and trading services in Hong Kong. | Digital Brokerage - B2C | |

| DriveWealth | DriveWealth is a FINRA regulated General Securities Broker Dealer with an internet based Wealth Building and Financial Literacy e-commerce application that will provide retail investors worldwide with investment opportunities in domestic and international equity markets thru individual stocks and ETF's, at the industry's lowest transaction costs. The online application was designed to create the optimal user experience by providing retail investors globally with Financial Education content. | Digital Brokerage - B2C | |

| eToro | eToro is an investment network offering social trading solutions through its community-powered network, which enables investors to see, follow, and automatically copy the actions of other investors in real time. eToro's mission is to open the financial markets to every individual and make them accessible through a simple, transparent, and more profitable way to trade and invest online. | Digital Brokerage - B2C | |

| Futu5 | Futu5.com (NASDAQ: FHL) focuses on providing online stock trading services for companies listed in Hong Kong and the U.S. | Digital Brokerage - B2C | |

| Kapitall | Kapitall is an online investing platform that combines the world's friendliest investing experience with powerful yet simple tools to build your skills and maybe even your net worth. | Digital Brokerage - B2C | |

| LOYAL3 | LOYAL3 offers a web and social media platform that enables companies to sell stock directly to customers in a way that is easy and affordable. The Customer Stock Ownership Plan, or CSOP, is designed to provide an easy and convenient way for companies to make public offerings of stock directly from the company's website or Facebook page with no fees. | Digital Brokerage - B2C | |

| Raisin | Raisin provides individuals and businesses across Europe with a destination to get access to savings products, ranging from overnight flexible savings to long-term deposits. The company offers its marketplace APIs to banks, wealth managers, and brokers in any country across Europe. | Digital Brokerage - B2C | |

| Robinhood | Robinhood is a financial services platform making America's financial system open to everyone. Robinhood's easy-to-use platform lets users invest in U.S. stocks and ETFs, commission-free, and Robinhood Gold, its paid service for active investors, supports margin and extended hours trading. | Digital Brokerage - B2C | |

| Rubicoin | MyWallSt helps people take control of their financial future by allowing them to buy shares in the top 1% of companies on the U.S. stock market through a smartphone. Learn by MyWallSt is a teaching app that helps demystify the stock market in small, bite-sized lessons. | Digital Brokerage - B2C | |

| Savedo | Savedo is an independent marketplace for fixed-term deposits in Europe. The finance portal offers German investors the opportunity to invest their money in fixed deposits with above-average interest rates in the euro area. Savedo is the first startup from the new FinTech company builder FinLeap. | Digital Brokerage - B2C | |

| SiliconInvesting | Silicon Investing is a brokerage providing free artificial intelligence and machine learning software to retail traders, including multiple platforms to execute trades and deep liquidity. | Digital Brokerage - B2C | |

| SOGOFinancialGroup | SogoTrade is an online discount stock brokerage firm offering a wide range of investment products including stocks, options, ETFs and educational savings accounts. With its five online trading platforms and its market research tools, SogoTrade provides its Customers with some of the best trading technology while delivering some of the lowest commissions in the industry. SogoTrade offers discounted online trades for as low as $3 for stocks and ETFs, and $5 for Options (plus 50¢ per contract). | Digital Brokerage - B2C | |

| Stockpile | Stockpile aims to make it easy for millennials and beginners of any age, including children, to learn about stock, get started investing in stocks or to gift stocks. Stockpile enables customers to buy fractional shares with as little as $5 making it possible for anyone to own stock in their favorite companies, including Amazon, Apple, Alphabet, Disney, Nike, Tesla and 1,000 other popular stocks as well as ETFs. | Digital Brokerage - B2C | |

| tastyworks | Tastyworks, formerly Dough, is a brokerage firm, creating and leading a financial revolution for the do-it-yourself investor. The brokerage firm was founded by the same anti-Wall Street team that created thinkorswim in 1999 and tastytrade in 2011. tastyworks supports investors who want to actively manage their own money with a powerful platform, embedded engaging content, and a unique commission structure. | Digital Brokerage - B2C | |

| Yomoni | Yomoni is an online private banking-style service that aims to make wealth management available to everyone. | Digital Brokerage - B2C | |

| ArtivestHoldings | Artivest offers ways to invest in private funds, including private equity, hedge funds and venture capital. The company is upgrading the entire process for investors and fund managers alike. Its technical, financial, and operational expertise powers a seamless experience for individual investors and a scalable point of access for financial advisors and fund managers. Artivest delivers institutional grade manager selection, featuring only funds that meet the highest standards. | Digital Brokerage - B2B | |

| Electronifie | Electronifie creates a fair and open marketplace that generates unprecedented liquidity for corporate bond investors. Both institutional investors and market-making dealers will participate in Electronifie's marketplace, which is designed to bring back block-sized liquidity to the corporate bond market by limiting information leakage and providing pre-trade price transparency for traders satisfying 'best ex' obligations. | Digital Brokerage - B2B | |

| OpenDoorTrading | OpenDoor Securities provides an anonymous, browser and session-based trading platform to improve liquidity across off-the-run Treasuries (OFTR's) and Treasury Inflation Protected Securities (TIPS), platform. | Digital Brokerage - B2B | |

| Trumid | Trumid, a FINRA-registered broker dealer, provides an electronic credit trading and market intelligence platform designed to unlock liquidity for institutional clients. The company's platform allows users to transact directly with other buy-side and sell-side participants, collectively determine pricing and execute a transaction at the market-vetted price. | Digital Brokerage - B2B | |

| CoInvestor | CoInvestor is an investment platform which enables private investors to co-invest alongside professional EIS fund managers on a deal by deal basis. | Digital Brokerage - Both B2C & B2B | |

| MotifInvesting | Motif Investing is a next-generation online broker that is pioneering concept-driven investing for individuals and financial advisors. The company, based in Silicon Valley, allows investors to trade 'motifs'-intelligently-weighted basket of stocks and bonds built around themes, investing styles or multi-asset models-in single transactions for low fees. Motif Investing is a registered broker dealer and a member of SIPC. | Digital Brokerage - Both B2C & B2B | |

| Tradier | Tradier is a financial services cloud provider that offers a groundbreaking solution to serve platform providers and investors. The Tradier solution features an innovative set of fully hosted APIs, modules and 'out of the box' tools that are leveraged by a growing list of providers. | Digital Brokerage - Both B2C & B2B | |

| Huddlestock | Huddlestock delivers a crowd investing platform giving users access to investments in a simple way. Hedge funds, investment banks, research houses, family offices and financial services firms supply researched investment strategies onto the platform. By pooling investments, users get access to high quality investment ideas at lower costs usually reserved for industry professionals. | Investing Tools - B2C | |

| Instavest | Instavest allows users to replicate the world's best investments. Investors can list their trades on Instavest, including the company, share amount and rationale behind the investment. Other users can invest alongside the people willing to share their own purchases and sales. | Investing Tools - B2C | |

| NerdWallet | NerdWallet is focused on helping people lead better lives through financial education and empowerment. When it comes to credit cards, insurance, loans or expenses like hospital costs, consumers make almost all their decisions in the dark. NerdWallet is changing that by building accessible online tools and providing research. | Investing Tools - B2C | |

| Nextmarkets | Nextmarkets develops a learning platform for trading on the stock exchange and other markets. | Investing Tools - B2C | |

| OpenfolioCorporation | Openfolio brings the power of networks - openness, connectivity, collective intelligence - to the world of personal investing. Openfolio benchmarks performance to networks, the markets and groups of peers. Once logged in, performance will update in real time. | Investing Tools - B2C | |

| Algomi | Algomi is a fixed income technology provider offering a bond information network that enables all market participants to securely and intelligently leverage data to make valuable trading connections. | Investing Tools - B2B | |

| Canalyst | Canalyst is an equity research technology provider for institutional finance professionals. Its cloud-based, on-demand equity model database enables CIOs, Portfolio Managers, and Directors of Research to uncover more, higher conviction investment opportunities by efficiently ramping up and expanding coverage based on the platform's robustness and breadth. | Investing Tools - B2B | |

| HarvestExchangeCorp. | Harvest is a financial technology company focused on aligning the interests of financial services firms and their clients by optimizing for relevance, efficiency and transparency. Harvest's A.I. powers a digital network platform that helps financial organizations compliantly distribute content to a highly targeted institutional and retail audience. Harvest's software analyzes and learns from millions of proprietary behavioral data points every month. | Investing Tools - B2B | |

| KenshoTechnologies | Kensho is empowering financial institutions with technology that brings transparency to markets. Kensho is pioneering real-time statistical computing systems and scalable analytics architectures-the next generation of improvements to the global financial system. Kensho harnesses massively-parallel statistical computing, user-friendly visual interfaces and breakthroughs in unstructured data engineering and predictive analytics to create the next-generation analytics platform for investment professionals. | Investing Tools - B2B | |

| LMRKTS | LMRKTS is a financial and operational risk mitigation service provider that uses mathematical optimization to reduce counterparty, market and settlement exposures. Its solutions address the FX and interest rate asset classes to reduce risk, leverage and gross notional across bilateral and cleared products. LMRKTS gathers exposure data, sets limits, defines objective functions and provides projected results enabling traders to verify the benefits and confirm participation. | Investing Tools - B2B | |

| OpenGamma | OpenGamma develops an open platform for analytics and risk management for the financial services industry. The company's flagship technology product, the OpenGamma Platform, is designed to allow financial services firms to unify calculation of analytics across the traditional trading and risk management boundaries. | Investing Tools - B2B | |

| Trackinsight | TrackInsight is an Exchange-Traded Funds (ETFs) analysis platform dedicated to professional investors, according to the MiFid definition. This platform enables asset owners to intuitively search, compare and select among the most significant European listed ETFs. A pan-European initiative, TrackInsight aims to bring transparency on the replicating qualities of ETFs to the end investors. | Investing Tools - B2B | |

| Alpaca | AlpacaJapan, dba Alpaca or AlpacaDB, is a Deep-Learning startup enabling AI technology to automate professional human tasks. Its product Alpaca Scan analyzes relevance between stock price fluctuation and various data in real-time. The firm has also developed its own database named MarketStore as a back-end infrastructure for Capitalico or Alpaca Scan focused on financial time-series data. AlpacaDB previously developed Capitalico, where even beginner traders can build their own trading algorithms. | Investing Tools - Both B2C & B2B | |

| Estimize | Estimize is an open source financial estimates platform. A diverse community of members from hedge funds and asset management firms, to independent analysts and investors, corporate finance professionals and students contribute earnings estimates. By crowdsourcing this data from a wide range of participants, Estimize represents the true expectations of the market, not just the narrow skewed view of the sell side analyst community. Estimize allows individuals and buy side professionals. | Investing Tools - Both B2C & B2B | |

| StockTwits | StockTwits is a financial communications platform for the financial and investing community. StockTwits created the $TICKER tag to enable and organize 'streams' of information around stocks and markets across the web and social media. These streams provide new forms of insight, ideas and information that are used by investors, analysts, media and others as they research stocks and manage their investments. | Investing Tools - Both B2C & B2B | |

| TradingView | TradingView is an active online trading community where traders and investors worldwide come together to analyze the markets and share ideas. | Investing Tools - Both B2C & B2B | |

| WikifolioFinancialTechnologies | Wikifolio Financial Technologies is the developer of the wikifolio social trading platform, aimed at democratizing financial investments. The company offers an online financial platform allowing both investment professionals and private individuals to conduct their investment strategies on virtual portfolios, called wikifolios. Each portfolio constitutes the basis for an exchange-traded financial product (wikifolio certificate) with an individual security number (ISIN) listed on the Stuttgart Stock Exchange. | Investing Tools - Both B2C & B2B | |

| Ycharts | YCharts provides individual investors with unique, innovative online tools that empower them to invest and trade stocks like professional money managers. | Investing Tools - Both B2C & B2B | |

| Grisbee | Grisbee is a site group purchasing of financial products for individuals (savings, credit, insurance, ...). Grisbee aims to help users in finding the best products and advice tailored to their situation. The website features include: A selection of attractive financial deals in place with banks and insurance partners, A board space adapted to the concerns of Internet users - a blog of news related to the management of personal finances. | Portfolio Management - B2C | |

| Addepar | Addepar is a financial operating system that aims to bring common sense and ethical, data-driven investing to the financial world. Addepar gives advisors and their clients a clearer financial picture at every level, all in one place and handles all types of assets denominated in any currency. With customizable reporting, financial advisors can visualize and communicate relevant information to anyone who needs it. | Portfolio Management - B2B | |

| Advizr | Advizr is a financial planning solutions available, automating advice delivery, empowering more advisors to participate in holistic advice and allowing more clients to receive financial plans regardless of their net worth. Its intuitive and sleek interface enables advisors to create and deliver comprehensive plans in minutes. | Portfolio Management - B2B | |

| iQuantifi | iQuantifi is a virtual financial advisor that provides comprehensive advice to millennials and young families to help them achieve their goals. The company's proprietary algorithm provides personalized and continuous advice based on the goals and resources of the user. | Portfolio Management - B2B | |

| Jacobi | Jacobi offers a suite of applications including portfolio construction and monitoring, risk management, reporting, and business development for investment managers. | Portfolio Management - B2B | |

| Quovo | Quovo is a data platform providing insights and connectivity for financial accounts across institutions. With a suite of APIs, modular applications, and enterprise solutions, Quovo helps deepen relationships by better connecting users to their clients' financial lives. | Portfolio Management - B2B | |

| Investcloud | InvestCloud is a California-based company, delivering the securities industry with collaborative cloud-based solutions. Equipped with its cloud delivery model, InvestCloud develops and deploys custom, scalable solutions with pace setting efficiency for asset managers, fund of funds, Investment Advisors, and the managers of pensions and endowments. These high-impact business solutions collaborate seamlessly with other technologies such as custodians and line-of-business applications and processes. | Financial Services Software - B2B | |

| PlaidTechnologies | Plaid is a provider of API that power developer of financial services applications and help them connect with user bank accounts. | Financial Services Software - B2B | |

| Riskalyze | Riskalyze empowers investment advisors to capture a quantitative measurement of client risk tolerance, and use that data to win new clients, capture and meet expectations, and quantify suitability. Riskalyze provides its technology to licensed investment advisors in the United States, who use it to capture risk tolerance and quantify suitability for their clients. | Financial Services Software - B2B | |

| Scivantage | Scivantage is a Global FinTech 100 technology provider of information-enabled software dedicated to transforming complex information and processes into intuitive user experiences for the financial services industry. With proven expertise in online brokerage, tax and portfolio reporting, and wealth management applications, Scivantage delivers intelligent and actionable information that goes beyond the boundaries of traditional financial software, helping improve investment decisions. | Financial Services Software - B2B | |

| StarburstLabs | Starburst Labs, formerly Gotham Tech Labs, creates, designs, develops, and operates a vertically aligned stack of vertical SaaS products that connect financial professionals with investing consumers. With a focus on simplicity and usability, its online products make use of modern design and development practices and reflect the growing consumerization of the financial enterprise. | Financial Services Software - B2B | |

| Qapital | The money app that makes it easy to fund your future – while taking care of your now. | Financial Services Software - B2C | |

| SmartAsset | A financial advisor can help simplify the complexity. | Financial Services Software - B2C |